What happens when a dog mom gets laid off from her job and has to start from scratch? She changes her money mindset. I know. Because she is me.

A few years ago, I was laid off from my job and had to start over. As soon as I got the notice, two major questions went off in my head. How was I going to take care of my bills? How was I going to take care of Sugar’s living expenses?

Enter: Dog Mom Math. My new budgeting and financial planning strategy. Although, I really wasn’t calling it “Dog Mom Math” at the time. It sounded more like, “Girl, you gotta make this work.”

However, adopting the new mindset helped me rework my budget and reduced my stress as I worked to find another job. The strategy worked so well that I decided to keep that same energy and continued using it after I got my new job.

So, in this blog post I’m introducing you to Dog Mom Math and how the mind shift helped me get my budget together.

WHAT IS DOG MOM MATH?

Getting laid off sucks. Honestly, I spent 2 days wallowing in self-pity. But then I thought to myself, “Girl, you’re better than this. Did you forget who you are?” So, I decided to get busy and focus on a solution. Dog Mom Math became the move.

Dog Mom Math is about making thoughtful, intentional money decisions that balance your dog’s needs with achieving your goals—turning everyday choices into financial wins.

It’s not about restriction or guilt—it’s about making intentional choices that align with your goals and your dog’s happiness. In other words, Dog Mom Math is about making your money work for you and your dog in this adulting game of life. Here are the rules:

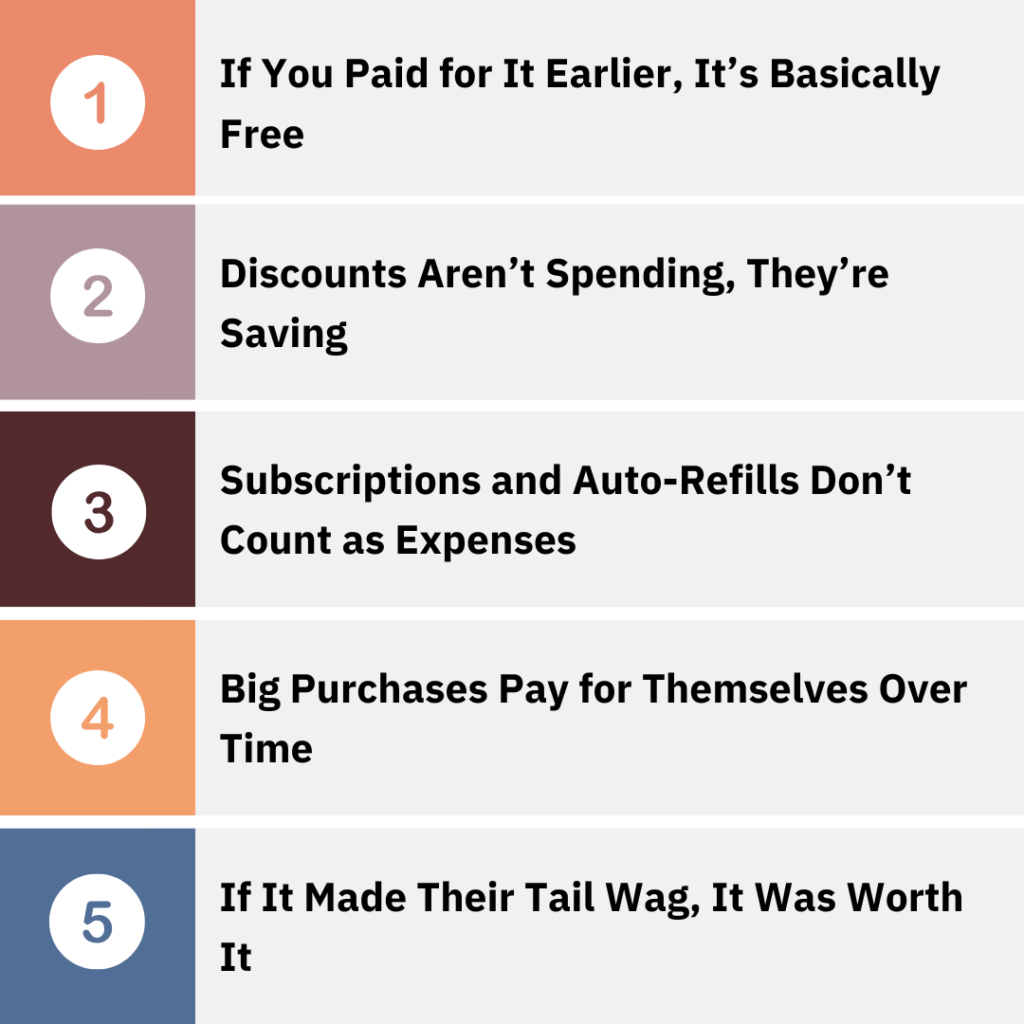

DOG MOM MATH RULES

These rules helped me put things into perspective, refocus, and manage Sugar and my expenses during my layoff.

DOG MOM MATH RULE #1: “IF YOU PAID FOR IT EARLY, IT’S BASICALLY FREE”

After I womaned up and left the self-pity party, I remembered that I had been saving $20 out of each of paychecks for the past year. So, I had $520 in cash savings. That was enough to cover 6 months of Sugar’s flea and tick preventative and 2 months of Sugar’s food.

Whoa! Look at me. Some of Sugar’s expenses I was worried about, were now basically free. At least for a little while.

In Dog Mom Math Rule #1, when you budget and save ahead of time for recurring expenses—like vet visits, annual vaccines, or bulk food purchases—the money feels “spent” already.

So, the expense feels “free” because the because the money has already been intentionally set aside over time.

The expense doesn’t feel like a sudden hit to your budget—it feels like a payment you’ve already made in advance. I was already practicing Dog Mom Math Rule #1 and didn’t even realize it. Here are a few ways you can get started.

Set Up a Vet Visit Fund – Put aside a small amount each month for annual checkups and vaccines. By the time the appointment comes, the money will already be there. The average cost of vet visit ranges from $700 to $1,500 depending on the services. Call your vet to get estimates. Use that estimate to determine how much you’ll need to save each month.

Plan for Seasonal Expenses – Budget ahead for flea and tick preventative and other medications for your dog. Add seasonal expenses to your budget as well, such as a coat or grooming.

Pre-Pay When Possible – Some vets and pet clinics offer wellness plans for your dog that lets you pay in advance. Consider signing up for a pre-pay plan. It allows you to spread vet costs over time instead of paying one lump sum.

DOG MOM MATH RULE #2: “DISCOUNTS AREN’T SPENDING, THEY’RE SAVING”

I spent 2 years saving my reward points and cash-back rewards for the “right moment.” And girl. This lay off was that “right moment.” Discounts and loyalty programs became another way to reduce Sugar’s expenses while I was laid off.

I cashed in $350 in cash back rewards from my credit card I’d been saving for 2 years. I also had $20 in rewards from PetSmart. Plus, they were having a sale. So, I was able to get 3 months of potty pads for free and Sugar’s grooming expenses were covered for 3 months.

Discounts aren’t spending in Dog Mom Math Rule #2. They’re saving. Every dollar saved through coupons, bulk purchases, or free shipping isn’t an extra expense—it’s money intentionally kept or redirected toward other financial goals. It’s not about shopping more; it’s about shopping smart.

So, these discounts helped me work it out. Here are some ways Dog Mom Math Rule #2 can work for you.

Subscribe to Sales Alerts – Sign up for email notifications from your favorite pet supply stores. Also, download store apps to receive push notifications to your phone. Use the sales alerts to map out the best time to purchase products and services for your dog.

Buy in Bulk – Purchase food, treats, or hygiene supplies in larger quantities to save per unit. I purchase Sugar’s potty pads in bulk to avoid spending the money every month. One box of 150 pads last for about 3 months.

Use Loyalty Programs – Many pet stores and other stores offer rewards programs that give discounts or cash-back on future purchases. A lot of them are free to join. Save up your rewards points until the “right time” to purchase.

DOG MOM MATH RULE #3: “SUBSCRIPTIONS AND AUTO-REFILLS DON’T COUNT AS EXPENSES”

The next step was to figure out my monthly budget. I needed consistency in my life. Especially, since I wasn’t sure when I was going to get another job. Which brings me to Dog Mom Math Rule #3.

Automating your recurring expenses means setting up automatic payments for costs like dog food, medications, or pet insurance, so they’re paid regularly without your direct effort. When expenses are automated, they become a seamless part of your financial routine. So, I put Sugar’s food and pet meds on AutoShip.

I knew exactly when her items were coming and how much it was going to cost me. Which made it easier to manage my budget. Plus, I didn’t have to worry about running out of her food and pet meds.

Dog Mom Math Rule #3 is all about turning your monthly expenses into a wellness routine. It’s about consistency and knowing where your money is going. Here are a few ways you can put it into practice.

Set Up Auto-Deliveries – Use subscription services for regular purchases like dog food, treats, or flea medication. A monthly $50 subscription for dog food feels far less stressful than running out unexpectedly and paying a premium for a last-minute purchase.

Take Advantage of Subscription Discounts – Many companies offer discounts for recurring deliveries.

Schedule Deliveries Around Paychecks – Align auto-payments with your pay cycle to ensure funds are available.

DOG MOM MATH RULE #4: “BIG PURCHASES PAY FOR THEMSELVES OVER TIME”

I was fortunate enough to receive a severance when I was laid off. So, I spent a portion of the check to get service maintenance repair on my car. Why? Because I needed it to work and didn’t want to have to face any unexpected car repairs while I was looking for another job.

According to Dog Mom Math Rule #4, this is considered a big, intentional purchase. When you invest in high-quality items, they last longer and perform better, reducing the need for replacements.

The cost of these purchases becomes smaller with every use, making them feel less like a splurge and more like a smart investment that continues to deliver value over time. So, the money I spent to make sure my car worked, would make sure Sugar and I would get to the places we needed to go without any problems.

Here are a few ways Dog Mom Math Rule #4 can turn your expenses into investments.

Identify High-Value Purchases – Items like orthopedic beds, durable carriers, or professional grooming tools. These items are often viewed as “splurge” or big-ticket items. They also might be those “treat yo self” products or services that’ve been sitting in your shopping carts for weeks.

Assess the Cost Per Use – Estimate how often the item will be used and calculate its value over time. For instance, if you use a $500 car seat for your dog 50 times for the year, it costs $10 per use.

Set An Investment Budget – Set aside money every month for those big purchases. This way you can pay cash when it’s time to buy the item. Which, brings us back to Dog Mom Math Rule #1 and makes your big-ticket item “free.”

DOG MOM MATH RULE #5: “IF IT MADE THEIR TAIL WAG, IT WAS WORTH IT”

I’ve always loved to bake. However, during my lay off, I got creative. Instead of baking for myself, I would bake for Sugar. I took $10 to buy ingredients to make Sugar’s first pupcake. And it was worth it. Not only did it give me a chance to relax between job applications and phone interviews. But it also brought Sugar some joy and gave us a chance to bond.

Dog Mom Math Rule #5 is all about intentional joy spending. When you make a purchase that brings your dog true joy—like a toy they love to play with or a special treat—it’s more than just money spent. These moments become emotional returns on your investment, strengthening your bond with your dog and creating priceless memories.

If the purchase is within reason and aligns with your financial plan, it’s not just an expense—it’s a meaningful investment in happiness. Here are a few ways to put this Dog Mom Math Rule in practice.

Identify What Brings Your Dog Joy – Think about the small things that consistently make your dog happy. The ones your dog gets excited about and often lead to the cutest social media-worthy reaction.

Create a “Fun Fund” Account – Set aside money for fun purchases. This helps you budget for those impulse buys for your dog and still stay within your budget.

Plan for Milestone Celebrations – Intentionally plan to celebrate Gotcha Days, birthdays, or even random Tuesdays. This way those celebrations are in your budget, and you can save for them over time.

MAKE THE MATH WORK FOR YOU

Every dog mom’s money story and situation are different. But life happens. The purpose of Dog Mom Math is to prepare for life’s adulting moments before it happens. Most importantly, it’s there to help you create a plan to achieve your financial goals.

Dog Mom Math isn’t about rigid rules. It’s a mindset. A lifestyle. It helped me during my lay off and still helps me as I work towards my financial goals today. Plus, Dog Mom Math helps me find little moments experience joy and spend quality time with Sugar each day.

Now, we’d love to hear your story. What’s your favorite Dog Mom Math Rule? How are you planning to implement it with your financial goals this year? Stay connected and share your pupcake stories with us @pupcakesugar.

MORE WITH DOG MOM MATH

Unexpected vet bills are only a surprise if you don’t plan for them. So, allow us to introduce you to The Beginner’s Guide to Dog Mom Math.

The Beginner’s Guide to Dog Mom Math is an eBook designed to help you achieve your goals and take control of your finances while managing your dog’s expenses.

Dog Mom Math is about making thoughtful, intentional money decisions that balance your dog’s needs with achieving your goals—turning everyday choices into financial wins. With 15 customizable templates, real-life examples, and practical tips, this guidebook is your step-by-step resource for building a financial plan that works for you and your dog.